Section 179: What You Need To Know

Tax Deductions for Technology Purchases

TABLE OF CONTENTS

Don’t Miss Out on Tax Deductions for Engineering Technology Purchases

If you’re running a company in engineering, manufacturing, or any field that involves design and prototyping, you know that high-quality software and equipment are essential for staying competitive. But what if there was a way to reduce the financial burden of purchasing expensive tools like CAD software, 3D printers, and scanning devices?

Enter Section 179 of the IRS tax code. This tax deduction allows businesses to write off the cost of qualifying equipment and software in the year the purchase is made, rather than depreciating it over several years. This deduction is an often underutilized opportunity for businesses to reinvest in the tools they need to grow.

-

3D Printing solutions

-

Additive Manufacturing equipment like Stratasys 3D printers and post-processing solutions are eligible for Section-179 tax deductions.

-

- Learn More >

-

SOLIDWORKS 3D CAD

-

SOLIDWORKS CAD, data management, simulation, and technical communication software is Section-179 eligible.

-

- Learn More >

-

Professional 3D Scanners

-

3D scanners from Artec, Creaform, and Peel 3D are eligible for immediate tax write-offs under Section-179.

-

- Learn More >

-

Out-of-the-Box Software

-

Many of the solutions in the GoEngineer portfolio are considered out-of-the-box and qualify for the Section-179.

-

- Learn More >

2024 Section 179 Details

60%

Bonus Depreciation for 2024

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment. With the Bonus Depreciation percentage set at 60% for 2024, and lowering further in the years to come, businesses have an incentive to make near-term purchases.

Bonus Depreciation is set to drop to 40% for 2025, and 20% for 2026.

$1,220,000

Deduction Limit for 2024

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2024, the equipment must be financed or purchased and put into service between January 1, 2024 and the end of the day on December 31, 2024.

$3,050,000

Spending Cap on Equipment Purchases for 2024

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive” (because larger businesses that spend more than $4,270,000 on equipment won’t get the deduction.)

To be eligible for 2024 rates and limits, you must take possession of any purchased equipment or software before year end, December 31st 2024.

Consult your tax professional to ensure your companies eligility.

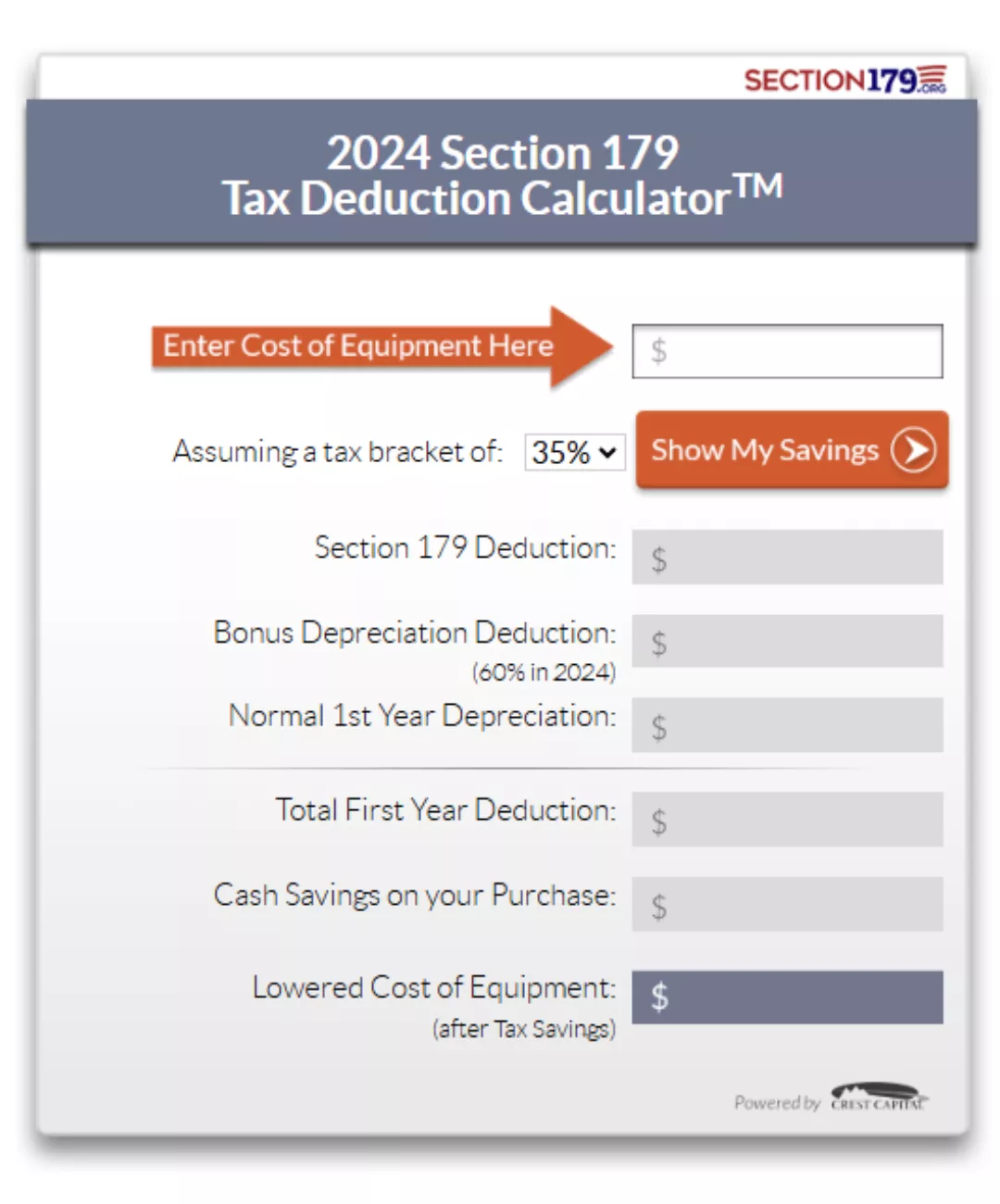

Are you considering whether or not to purchase or lease equipment in the current tax year? This Section 179 Deduction Calculator for 2024 may very well help in your decision, as Section 179 will save your company a lot of money.

To calculate your savings, here is a link to the Official 2024 Section 179 Calculator | Section179.Org

Consult your tax professional for a full understanding.

© GoEngineer. All rights reserved | Privacy Policy

GoEngineer delivers software, technology and expertise that enable companies to unlock design innovation and deliver better products faster. With more than 30 years’ experience and thousands of customers in high tech, medical, machine design, energy and other industries, GoEngineer provides best-in-class design solutions from SOLIDWORKS, Stratasys, CAMWorks, Product Lifecycle Management (PLM) and more.